| Single State Edition: $129.99 + $24.99/mo |

|

| 50 State Edition: $1199.99 + $39.99/mo |

Miva Merchant 5 Sales Tax Solution

This "software and data as a service" provides you with a "setup once and forget about it" tax calculation system for your online store.

The module plugs directly into Miva Merchant 5, provides comprehensive tax calculations for your store including automatic determination of whether shipping or shipping/handling is taxed, and is automatically updated monthly while your subscription is current.

This unique service includes:

- One year subscription to the single or 50 state edition of TDS Basic zip-based sales and use tax database

- A Miva Merchant 5 Tax module for your store to calculate proper sales or use tax based on zip codes

- Automatic tax rate database delivery to your Miva Merchant store monthly*

- Additional year subscriptions for the tax database are currently $100/state for the Single State Edition or $500/year for the 50 State Edition

Upon purchase of this service you will immediately receive:

- A welcome message from the eMediaSales Tax Delivery control panel to manage your tax subscription

- Access to the module zip file to install in your Miva Merchant 5 store

- Instructions on installing and configuring the module

- New: Now includes free installation! Just submit a request via our help desk!

Tax Rates are generally delivered to your store within 15 minutes of installation.

Help And Screen Instructions

While your Miva Merchant tax module will probably be pre-installed for you (if you choose to have us do it), here are the steps so you can understand the Miva Merchant tax module.

Miva Merchant Tax Module Installation

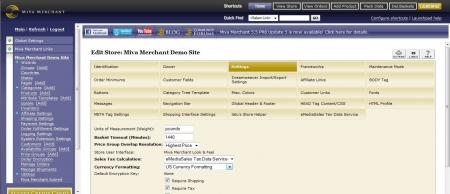

Tax modules for Miva Merchant are installed first in the "Domain Settings", then installed in the store in the "Store Settings"

|

|

Domain Installation

|

|

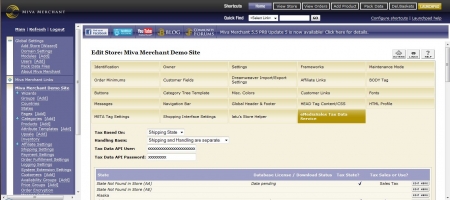

Store Tax Setting / Tax Module Installation

*Note: This will remove any other tax module you have in your store, since Miva Merchant can only have one tax module installed. Your settings to the old module will be lost, so you may want to make a backup copy of your store in case you chose to go back to your old tax calculation. |

Miva Merchant Tax Module Settings

The following configuration options are available for the Tax Module for Miva Merchant 5, and are available in the Store Settings => eMediaSales Tax Data Service tab.

Store Wide Configuration - Tax Calculation PropertiesThese configuration options are global and will affect how the store in general is configured for tax collection. These settings will then be used by the state settings to determine overall tax for the state.

The final two configuration parameters connect your site to our tax delivery control panel for initial site registration and ongoing tax rate database update deliveries. |

|

|

Frequently Asked Questions

- When are tax database updates delivered to my store?

Generally speaking, we receive the full 50 state tax database from Tax Data Systems for the next month a few days before the end of each month. We upload these in advance, and our server processes them around 2AM Pacific time on the first day of the month. We then immediately begin distributing the tax database updates to all stores immediately. Your tax rate updates should be delivered within several hours. - How reliable is a zip-code based sales tax database?

While it is true that some counties and localities can span and cross zip codes, the practice of utilizing Zip based tax databases is quite common in ecommerce stores. A true street level locality validation would be a much more expensive solution. We have opted to intially implement TDS, Inc.'s "AS_basic" tax database as we are aware of many large merchants utilizing this exact database. Whether or not this potential margin for error is acceptable is purely up to you and your tax accountant. Please note that you are responible for final accurate reporting and payment of taxes to the tax jurisdictions regardless of what you collect, and neither eMediaSales or Tax Data Systems, Inc., guarantee that you will collect the precise amount of tax on every order. - What happens when zip codes are added or deleted?

TDS employs a staff of researchers who compile the databases based on public records, and they keep the database up to date monthly. When new or changed zip codes and tax rules take effect, these changes are included in the monthly updates. - Does the module handle tax holidays?

No. However, our delivery system will check your store periodically to determine if you require a tax database update. So if you had a state wide tax holiday you wanted to observe, you could remove the module temporarily and install the built-in Miva Merchant State Based Sales Tax module, and set your tax for the day to 0%. When your tax holiday is complete, simply put our module back in place, reconfigure the states for which you will collect tax, and enter in your API credentials. Our system will recognize that you need a tax update and send new rates to your store in as short as 15 minutes. - May I change the state in which I will collect tax?

If you have a single state edition, we will send at most one state at any time to your store. You may change which state you will collect tax but it must match our online control panel which will only permit one state selection at a time (unless, you have purchased multiple individual states). The long story short is, if you have one state database license your store will only receive rates for that one configured state at any time, but that one state CAN be changed, eliminating tax calculations for the original state. - Can I collect for more than one but less than 50 states?

Yes, we can enable any number of states in your control panel. Additional states are $100 per state for the database and $5.00/month for update deliveries, up to the price of the 50 state delivery service. Please contact us by email or phone for multi-state pricing.

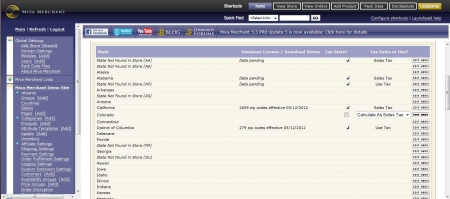

Individual State Configuration

Individual State Configuration